Strong growth and strong partnerships

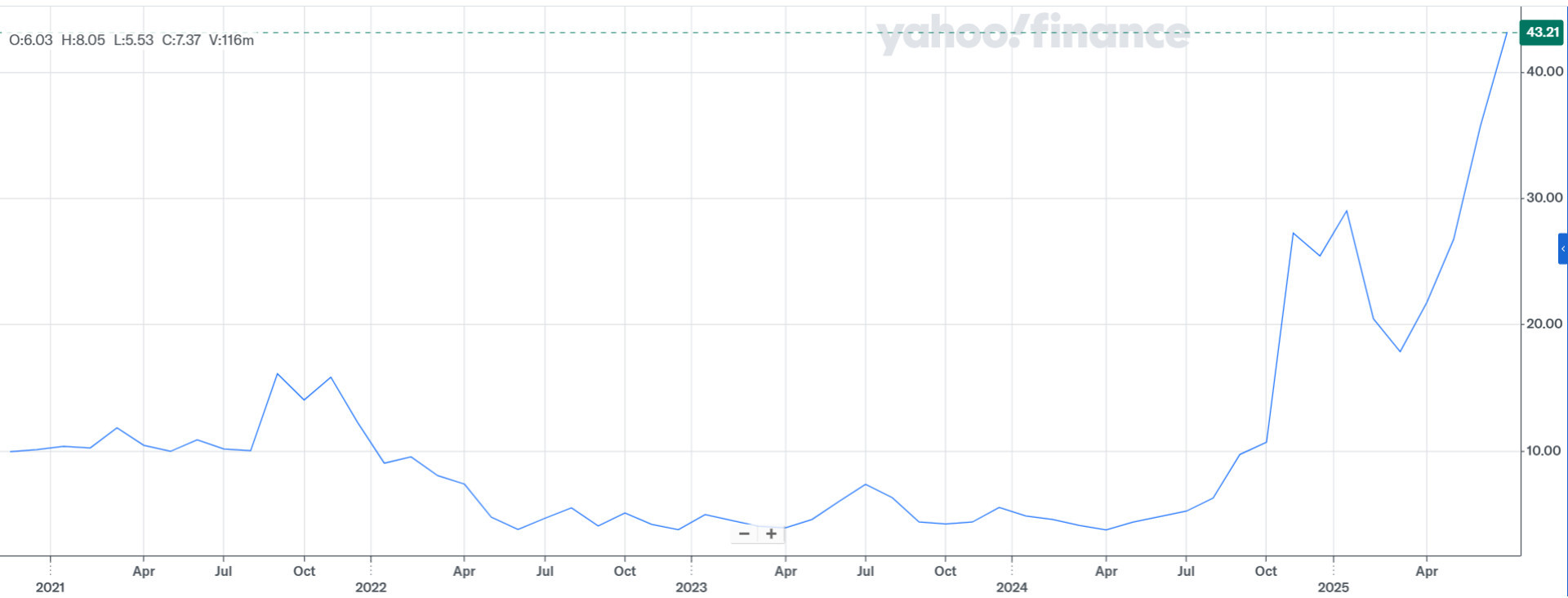

Starting with the focus, the company deals with the most modern space technology, and from 2024, investors can currently see an appreciation of more than 1,000% with this investment. To some investors, this number might seem suspiciously high, but at the same time, it is crucial to note that the growth was also directly supported by the company's growing fundamental situation.*

Most recently, it managed to carry out the 68th successful launch of the Electron rocket, including two launches in 48 hours, which confirm the technical maturity and reliability of their rocket technology. Following this, Rocket Lab has also signed a contract with the European Space Agency (ESA), with which it plans to launch satellite systems, before December 2025.

Source: Yahoo Finance*

Where does a company have a competitive advantage?

Upon closer examination of Rocket Lab's business, it can be found that the aforementioned Electron system is defined as small within its size, which brings with it one very key factor that investors will undoubtedly appreciate when planning investments. Given that the space business is relatively only at the beginning, many companies cannot afford traditional large rocket launches, which is why Rocket Lab wins by a wide margin when choosing a satellite carrier for orbit. Of course, very beneficial. In addition, according to the latest information, the company is able to produce one rocket every 15 days, which is, of course, very beneficial for the expansion and also for the final result.

Outlook for investors

In conclusion, Rocket Lab is currently one of the most interesting stories in the space technology market. With record share price growth, a strong portfolio of partnerships and a strategic focus on small rocket launches, the company is becoming a key player in this segment, and as an investor you can be part of this whole, especially in its beginnings with long-term growth potential.

* Historical figures are not a guarantee of future returns.

Warning! This marketing material is not and should not be construed as investment advice. Data relating to the past are not a guarantee of future returns. Investing in foreign currency can affect returns due to fluctuations. All securities trades can lead to both profits and losses. Forward-looking statements represent assumptions and current expectations that may not be accurate or are based on the current economic environment, which is subject to change. These statements do not guarantee future performance. InvestingFox is a trademark of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://www.cnbc.com/2025/07/14/rocket-lab-stock-space.html

https://rocketlabcorp.com/updates/new-blog-post-21/

https://www.cnbc.com/2021/08/25/rocket-lab-begins-trading-on-nasdaq-as-rklb-after-spac-merger.html

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italian

Italian

Polish

Polish