Trading Instruments

Stock indices, often referred to simply as "indices," are indicators that track and measure the performance of a specific group of stocks in a stock market. They provide a snapshot of how a particular market or sector is performing by aggregating the prices of selected stocks within that market or sector. Stock indices are widely used by investors, analysts, and the media to gauge the overall health and trends of the stock market. The most well-known indexes include the Dow Jones Average, Nasdaq Composite, S&P 500, CAC 40, FTSE 100, DAX or SSE Composite Index.

Instrument |

Lot size |

Typical Spread (starting from)** |

Leverage (up to)* |

Trading hours (CET) |

|---|---|---|---|---|

| .DE30_ | Value of 25 cash contracts | 48.32 | 1:20 | 8:00 am - 10:00 pm |

| .DE30Cash | Value of cash contract | 48.32 | 1:20 | 0:05 am - 11:00 pm |

| .EURO50Cash | Value of cash contract | 14.05 | 1:20 | 8:00 am - 10:00 pm |

| .FRANCECash | Value of cash contract | 23.03 | 1:20 | 8:00 am - 10:00 pm |

| .HKCash | Value of cash contract | 116.9 | 1:10 | 3:15 am - 6:00 am, 7:00 am - 10:30 am, 11:15 am - 9:00 pm |

| .JAPANCash | Value of cash contract | 180.25 | 1:20 | 0:05 am - 11:00 pm |

| .UK100Cash | Value of cash contract | 3.55 | 1:20 | 0:05 am - 11:00 pm |

| .US30_ | Value of 5 cash contracts | 49.44 | 1:20 | 0:05 am - 11:00 pm |

| .US30Cash | Value of cash contract | 49.44 | 1:20 | 0:05 am - 11:00 pm |

| .US500_ | Value of 50 cash contracts | 5.11 | 1:20 | 0:05 am - 11:00 pm |

| .US500Cash | Value of cash contract | 5.11 | 1:20 | 0:05 am - 11:00 pm |

| .USTECHCash | Value of cash contract | 11.26 | 1:20 | 0:05 am - 11:00 pm |

| .US2000Cash | Value of cash contract | 2.59 | 1:20 | 0:05 am - 11:00 pm |

Right after you open or close your trading position, spread will be deducted from your account, which is the difference between the current ask and bid price. Please note: InvestingFox reserves the right to expand spread according to its discretion, reduce leverage, set the maximum limit of orders and the total client exposure. InvestingFox also reserves the right to increase margin in those situations when the market conditions require so.

* Trading complex products with higher leverage implies a high level of risk and may result in the loss of all or part of your invested capital.

** As soon as your trading position is opened, the spread will be withdrawn from your account, which represents the difference between the current buying and selling price.

Learn how to trade on Demo

Are you new to the world of financial markets and trading opportunities? Try our Free Demo Account to learn how to trade, gain new knowledge and learn how to navigate the trading platform and the financial markets to make better investment decisions.

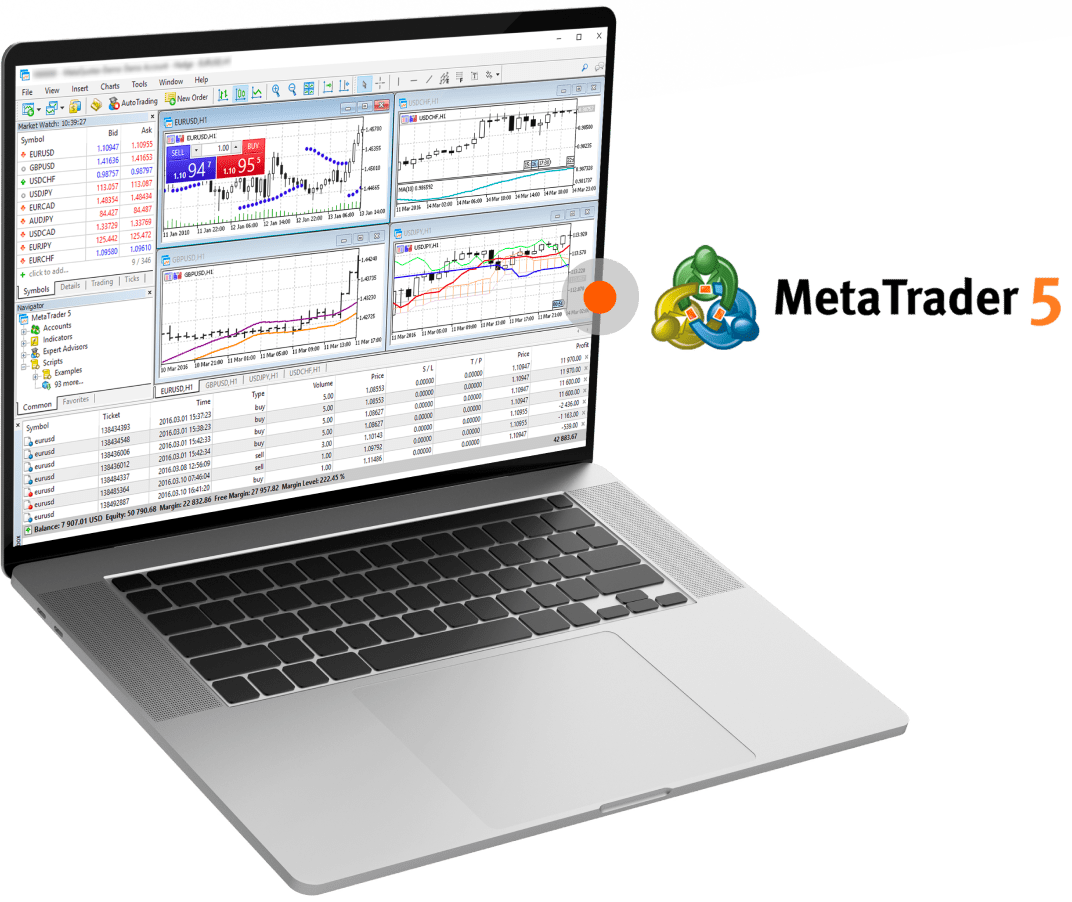

Powerful trading platform

InvestingFox offers a professional trading platform - MetaTrader 5. It is designed to provide a simple user and trading environment to achieve the desired goals, regardless of your preferences or experience.

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italiano

Italiano

Polish

Polish