Express Agreement

On Monday, April 14, 2025, the North Atlantic Alliance (NATO) announced that its Communications and Information Agency had acquired the crucial Maven Smart System (MSS NATO) from Palantir. Through this system, the American company offers a vast array of applications ranging from machine learning and generative AI to large language models, which are designed to assist soldiers and decision-makers in making quicker and more efficient decisions on the battlefield and streamlining the flow of information. The system will also serve as a foundation for the development of new AI models. While NATO's statement did not disclose any specific financial details, this acquisition marks the fastest in the alliance’s history—taking only six months from initial concept to acquisition. The MSS NATO system is expected to be deployed as early as next month.

Also Noticed by the Pentagon

However, NATO is not the only entity utilizing Maven. The Pentagon has had access to the system since last year. Thanks to a five-year contract worth more than half a billion USD, all levels of the U.S. Department of Defence worldwide will be able to use the system, which has already been integrated into the operations of the Air Force, Army, and Space Force. Due to its advanced technologies, Palantir could soon appear on the list of companies eligible to receive a portion of the multibillion-dollar defence budget—one that, according to The Motley Fool, Donald Trump referenced in early April.

Does More Than Just Defend

Palantir doesn’t focus solely on the defence sector—its cutting-edge AI products are used across a variety of industries, from insurance and mobility to retail. Another key sector is healthcare, where as much as $160 billion is allocated to proper revenue cycle management. In cooperation with R1, a company specializing in revenue cycle management, Palantir has developed a lab aimed at streamlining financial operations. The project is currently in the testing phase and is expected to be available to initial clients in the second half of the year.

Growth Forecasts Continue

Collaboration with government agencies and private enterprises is likely to further strengthen the company’s position. Palantir expects its full-year revenue to reach between $3.74 and $3.75 billion, which would represent a growth of over 30% if the midpoint is achieved. The company also anticipates strong growth in revenue for the first quarter of 2025, estimating between $858 and $862 million.[1] These results are scheduled to be published on May 5, 2025. Palantir closed out 2024 with a 29% increase in annual revenue, with a 36% rise in the final quarter alone—bringing quarterly revenue to over $608 million. During the same quarter, the U.S. government contributed $343 million to Palantir’s revenue, marking a 45% year-over-year increase. Meanwhile, the commercial segment in the U.S. rose by 64% to $214 million, with expectations for this figure to grow toward the $1 billion mark.[2]

However, future developments—including financial ones—may also be influenced by the ongoing global trade war, raising questions about the company’s next projections.

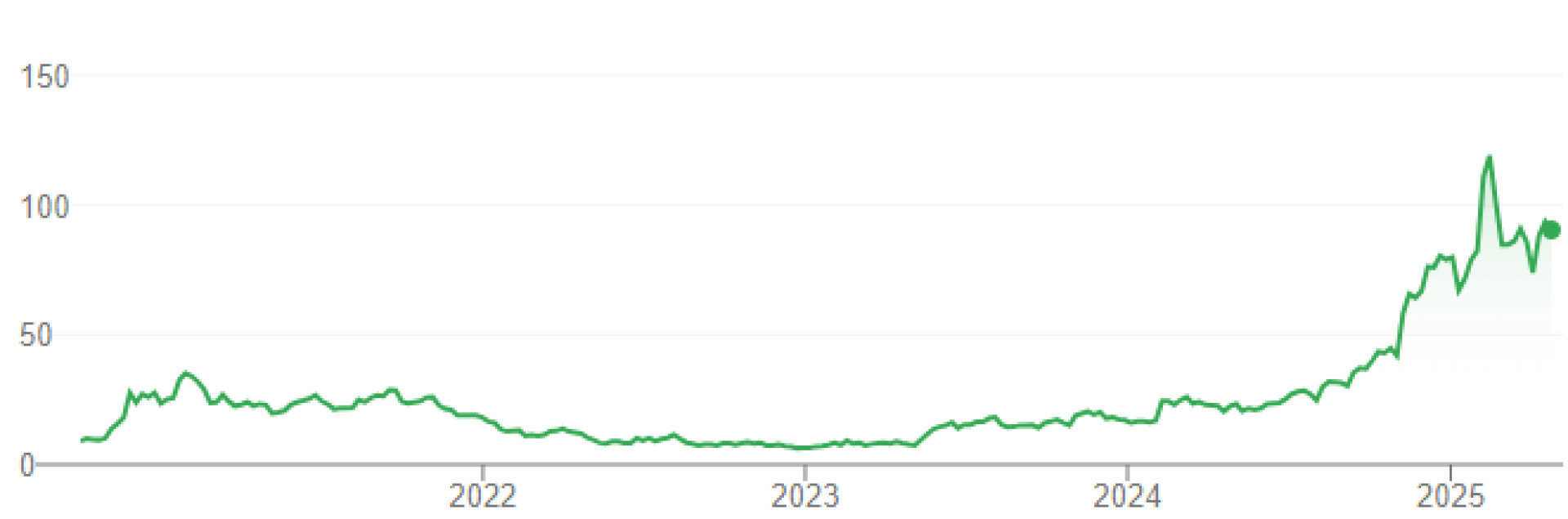

Solid Stock Performance

The software company continues to perform well on the Nasdaq. Following the news of its acquisition of the Maven system, Palantir’s shares jumped more than 10% over just two days. Although the stock traded lower on April 21, 2025, closing at $90.80, it has still posted a 20% gain so far this year despite short-term pullbacks. The all-time high was reached fairly recently, on February 18, 2025, when shares hit $124. What stands out is the company’s impressive triple-digit growth in recent years. Over the past year, the stock surged by 333%, and looking at a five-year horizon, it has skyrocketed by more than 886%.*

Source: Google Finance*

Conclusion

Palantir CEO Alex Karp sees artificial intelligence as the driving force behind the company’s growth, with Palantir firmly positioned at the heart of the tech boom. The speed at which the company sealed a deal with NATO, along with ongoing cooperation with the U.S. government, shows that it’s becoming an increasingly powerful player. At the same time, its focus on expanding into other sectors helps reduce its dependence on government contracts. If Palantir can maintain the trust of its commercial partners, it could play a key role in bringing advanced AI technologies into everyday use.[3]

* Data related to the past are not a guarantee of future returns.

[1, 2, 3] Forward-looking statements represent assumptions and current expectations, which may not be accurate or are based on the current economic environment, which is subject to change. These statements do not guarantee future performance. By their nature, forward-looking statements involve risk and uncertainty because they relate to future events and circumstances that cannot be predicted, and actual developments and results may differ significantly from those expressed or implied in any forward-looking statements.

Disclaimer! This marketing material is not and must not be construed as investment advice. Data related to the past are not a guarantee of future returns. Investing in a foreign currency may affect returns due to fluctuations. All securities transactions can lead to both profits and losses. Forward-looking statements represent assumptions and current expectations, which may not be accurate or are based on the current economic environment, which is subject to change. These statements do not guarantee future performance. InvestingFox is a trade name of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://shape.nato.int/news-releases/nato-acquires-aienabled-warfighting-system-

https://finviz.com/news/19884/why-palantir-stock-is-soaring-today

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italian

Italian

Polish

Polish