Results Fell Short of Expectations

In the first quarter of 2025, the American manufacturer reported a significant drop in operating income, which plunged by 66% to just under USD 400 million, with an operating margin of 2.1%. The company also saw a decline in total revenue, which fell by 9% year-over-year to USD 19.3 billion. Net income dropped by more than 70%, with earnings per share (EPS) at USD 0.27. According to its financial report, the company attributed the decline to lower average selling prices of vehicles, reduced deliveries due to updates of the Model Y across all factories to newer versions, and increased spending on artificial intelligence. The reported results also missed analysts’ expectations from LSEG, who projected revenue of over USD 20 billion and EPS of USD 0.39. When breaking down revenue by segment, the automotive division performed the worst with a 20% decrease. On the positive side, revenue from energy generation and storage surged by 67%, while service-related revenue rose by 15%.

Forecasts Postponed to the Second Quarter

Tesla views the current situation with uncertainty due to ongoing macroeconomic developments, including global trade policies, and has not yet offered any specific outlook. However, it announced that it will reassess its forecast in the second quarter of this year, assuring investors that it is making well-considered investments and has sufficient financial resources. The company expects that its future profitability will be driven by artificial intelligence, software, and vehicles. Regarding the latter, Tesla estimates that its long-awaited affordable cars should enter production in the second half of this year. Thanks to more efficient use of production lines, vehicle output is expected to increase by up to 60% year-over-year. The Cybercab robotaxi is scheduled to begin production next year, while estimates for the humanoid robot Optimus point to thousands being manufactured in 2025. However, Tesla is facing export challenges from China, which has restricted the export of rare earth elements to the U.S. as part of regulatory measures. The company is now seeking a license to use these materials for its robotics production.

Chinese Tariffs and Their Impact on Tesla

Despite CEO Elon Musk’s close ties to the U.S. president, he and the administration differ significantly when it comes to tariffs. As CNBC reports, Musk claims that Tesla is the “least affected,” but the situation is more complex. While the company may not be directly hit by American tariffs, it is impacted by China’s retaliatory measures—especially those involving battery cells used in Tesla vehicles. To address the issue, Tesla is exploring the establishment of domestic U.S. production for battery cells or securing alternative suppliers outside of China. However, both solutions require significant time to implement.

Stock Reaction

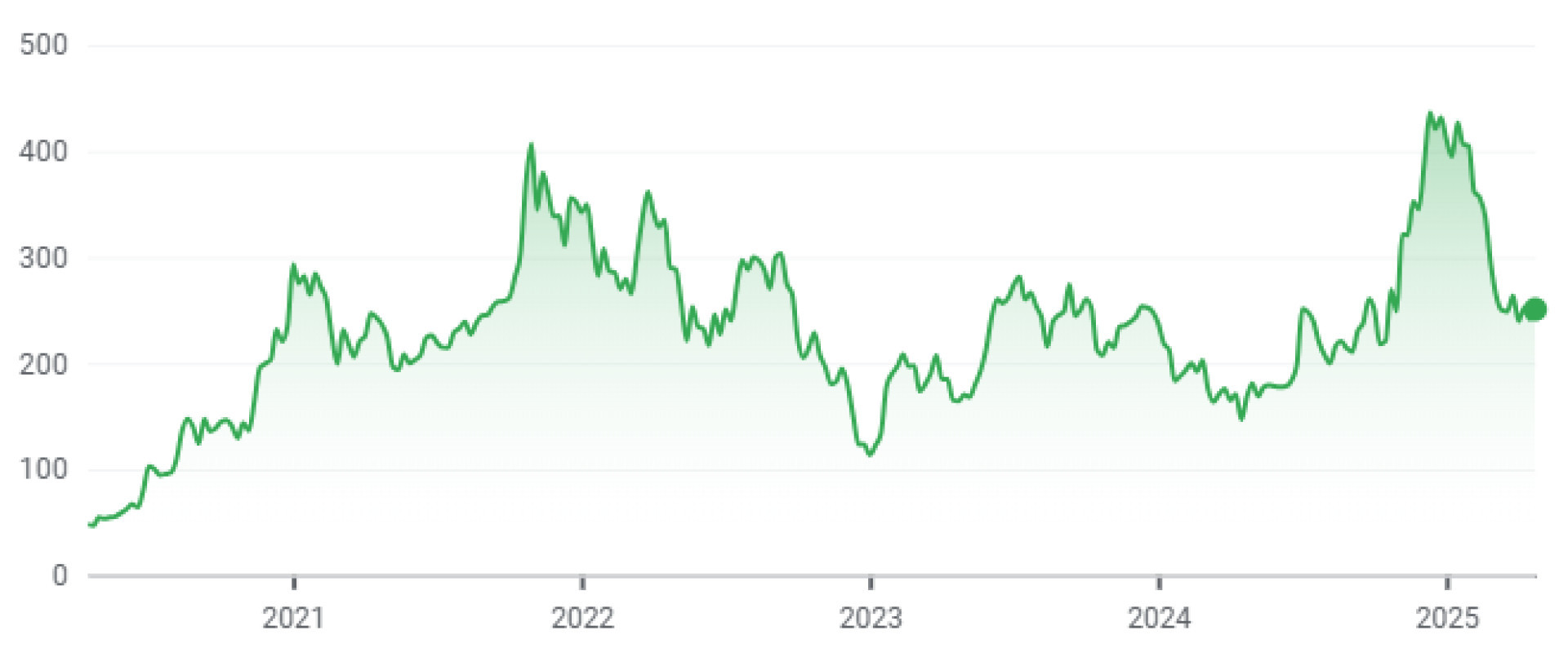

Despite unfavourable economic results, the stocks were trading 7.6% higher in the pre-market on April 23, 2025, and ended the day with a 5% increase at $250.74. The growth was driven by statements from Elon Musk, who is expected to dedicate more of his time to business activities than to political ones starting next month. It was precisely because of his political involvement and controversial statements that he was often a subject of debate, which negatively impacted Tesla's stock performance. Although the statement provided some relief for the stocks, they have lost 37% of their value since the beginning of the year. Their annual performance is better, with a growth of 54%, while over the past 5 years, it has been as high as 418%.*

Source: Google Finance*

Opportunity, but with Tough Conditions

Tesla continues to expand its reach, and after its debut in Saudi Arabia in early April, it is also in active discussions with India. The company is pursuing regional diversification due to declining sales, as CNBC reports, seeing India as a great market thanks to its large middle class. However, there are still challenges that need to be addressed. These include the ubiquitous tariffs—while the U.S. has imposed a 10% tariff on India, with the potential to rise to 26% after 90 days, India itself has a 70% tariff on the import of electric vehicles, along with a 30% luxury tax. To avoid such high surcharges, under a new Indian law, Tesla would need to build a manufacturing plant within a few years, which would reduce the tariff to 15%.

Conclusion

Despite the decline in its financial results, Tesla still has much to offer the market. The long-awaited cheaper model, artificial intelligence, the Cybercab, along with Musk's promise to spend more time on his businesses, highlight the potential that investors can tap into, even amid short-term market downturns. An important update will be the outlook in the second quarter, which may provide more insight into the company’s future direction. [1]

* Past performance is not indicative of future returns.

[1] Forward-looking statements represent assumptions and current expectations that may not be accurate, or may be based on the current economic environment, which can change. These statements do not guarantee future performance. Forward-looking statements inherently involve risks and uncertainties because they relate to future events and circumstances that cannot be predicted, and actual developments and results may differ significantly from those expressed or implied in any forward-looking statements.

Disclaimer! This marketing material is not and should not be construed as investment advice. Past performance is not indicative of future returns. Investing in foreign currencies may affect returns due to fluctuations. All securities transactions can result in both profits and losses. Forward-looking statements represent assumptions and current expectations that may not be accurate, or may be based on the current economic environment, which can change. These statements do not guarantee future performance. InvestingFox is a trademark of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://digitalassets.tesla.com/tesla-contents/image/upload/IR/IR/TSLA-Q1-2025-Update.pdf

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italiano

Italiano

Polish

Polish