Strong results despite challenges

CVS Health achieved better-than-expected results in the fourth quarter of 2024, despite ongoing issues in its insurance division. Revenue increased by more than 4% year-over-year to $97.71 billion, with adjusted earnings per share (EPS) at $1.19. Both indicators exceeded forecasts, as analysts at LSEG, according to CNBC, expected revenue of $97.19 billion and EPS of $0.93. The primary driver of growth was the insurance division, which saw a 23% year-over-year increase in revenue to nearly $33 billion but reported an operating loss of $439 million. In 2023, it had an operating profit of over $670 million. The decline was due to higher costs and the assessment of the private Medicare Advantage insurance plan. Nevertheless, the company’s Chief Financial Officer, Thomas Cowhey, expected worse results than what was actually reported, according to CNBC. Pharmacy revenue from the company’s 9,000 locations across the U.S. was up 7% year-over-year at $33.51 billion. Sales were influenced by an increase in prescriptions, reimbursement pressures, a lower number of retail locations, and reduced sales of goods like toilet paper and groceries. The lowest growth was recorded in the healthcare services segment, which saw revenue increase by only 4% to just over $47 billion. This segment includes the subsidiary Caremark, which negotiates lower prices for clients. The division prescribed 100 million fewer prescriptions year-over-year in the last three months of 2024 due to the loss of a major client. All three segments exceeded analysts’ expectations from StreetAccount.

Optimistic outlook for 2025

Another positive sign was the company’s forecasts for the current year. CVS Health expects adjusted EPS to be in the range of $5.75 to $6.00, indicating potential improvement. CEO David Joyner, who took over the company’s leadership as part of a management reorganization last fall, is focusing on change by cutting costs by $2 billion over the next few years. Another strategy is improving Medicare Advantage margins, which were at -4.5% to -5% at the end of last year. The goal is to achieve margins of 3% to 5%, which could be aided by reducing the number of clients by about 1 million and improving Medicare ratings, which would increase payments received from the government in 2026.[1]

Stock gains after results

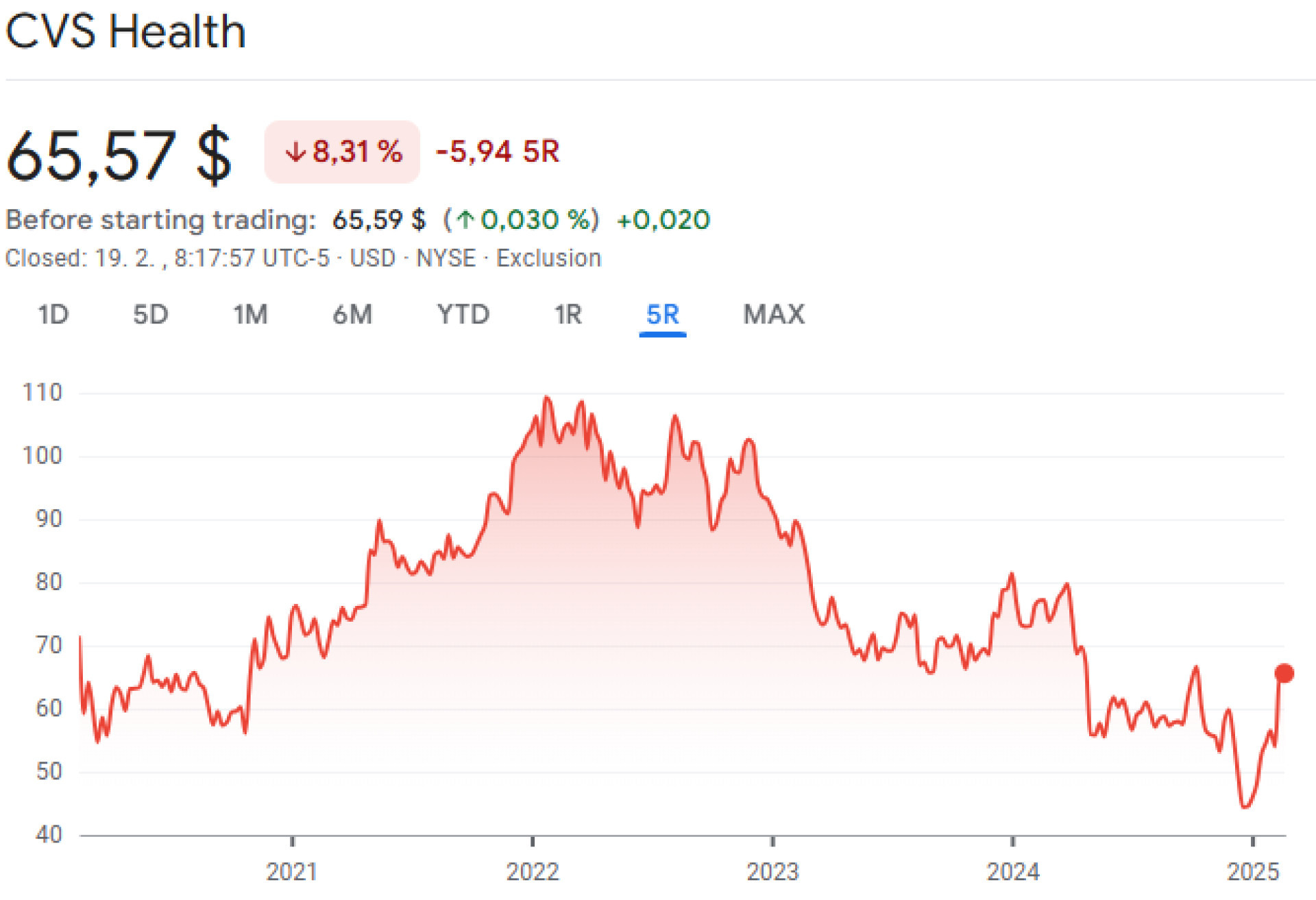

CVS Health struggled to meet expected quarterly results last year and even had to lower its annual forecasts for 2024. The reason was high costs in the Medicare insurance unit, which accounts for half of the company’s expenses, along with other issues. The latest results, combined with a positive outlook for 2025, reassured investors, which was reflected in the company’s stock performance. Shares opened trading on February 12, 2025, 10% higher at $60.59 and extended gains by another 10% the following day. As of February 19, 2025, the stock price had declined to $65.57. Since the beginning of this year, shares have gained more than 46%. However, year-over-year, CVS has lost 15% on the stock market, and over a five-year period, it has been down about 8%.*

Source: Google Finance*

Apps to improve accessibility

CVS Health is working to make healthcare more convenient for its customers. The new CVS Health mobile app is designed to simplify everything from prescription management to vaccination scheduling. The improved app allows users to manage prescriptions for multiple family members and streamlines pharmacy visits. CVS is even testing an option to unlock security cabinets via the app for easier access to certain products. Since artificial intelligence has been integrated into various industries, the company has incorporated it into its services as well. The goal is to enhance user experience and help customers find the information and products they need. CVS also plans to launch an AI-powered chatbot for pharmacies this year.

Under fire from criticism

CVS has found itself at the center of heated debate over the role of pharmacy benefit managers (PBMs). CEO David Joyner has taken a firm stance in defending the company’s Caremark unit, which operates as a PBM. PBMs act as intermediaries between drug manufacturers, insurers, and pharmacies, negotiating discounts and determining drug reimbursements within insurance programs. Critics argue that PBMs artificially inflate drug prices and do not pass savings on to patients but instead keep them for themselves. They have gained support from both political parties, as well as from current President Donald Trump. During a quarterly earnings discussion, Joyner rejected these accusations, claiming that PBMs are actually a driving force behind lowering healthcare costs. Instead, he pointed the finger at drug manufacturers for monopolistic practices. According to him, PBMs generate annual savings of more than $100 billion for the U.S. healthcare system.

Conclusion

CVS Health enters 2025 with a clear plan to improve financial stability and strengthen its services. Despite challenges in the insurance sector, the company maintains a strong market position and continuously innovates its services to enhance healthcare accessibility. The positive response from investors indicates confidence in its strategy and future prospects. The question remains whether CVS will be able to effectively implement its planned steps and sustain long-term growth.

* Past performance is not a guarantee of future returns.

[1] Forward-looking statements represent assumptions and current expectations that may not be accurate or are based on the current economic environment, which may change. These statements do not guarantee future performance. Forward-looking statements inherently involve risk and uncertainty as they relate to future events and circumstances that cannot be predicted, and actual developments and results may differ significantly from those expressed or implied in any forward-looking statements.

Disclaimer! This marketing material is not and should not be considered investment advice. Past performance data is not a guarantee of future returns. Investing in foreign currencies may impact returns due to fluctuations. All securities transactions can result in both gains and losses. Forward-looking statements represent assumptions and current expectations that may not be accurate or are based on the current economic environment, which may change. These statements do not guarantee future performance. InvestingFox is a trade name of CAPITAL MARKETS, o.c.p., a.s., regulated by the National Bank of Slovakia.

Sources:

https://www.cnbc.com/2025/02/12/cvs-health-cvs-earnings-q4-2024.html

https://finance.yahoo.com/news/cvs-reaps-benefits-improved-pharmacy-141427134.html

English

English

Slovak

Slovak

Czech

Czech

Hungarian

Hungarian

Italiano

Italiano

Polish

Polish